Amgen Overview

Amgen Inc. (Amgen) is a biotechnology company. The Company is engaged in discovering, developing, manufacturing and delivering human therapeutics. The Company’s sales and marketing forces are located in the United States and Europe. In the United States, it sells its products to pharmaceutical wholesale distributors. The Company also markets certain products directly to consumers through direct-to-consumer print and television advertising, as well as through the Internet. Outside the United States, the Company sells its products to healthcare providers and/or pharmaceutical wholesale distributors. The Company’s products include Neulasta (pegfilgrastim)/NEUPOGEN (filgrastim), Enbrel (etanercept), XGEVA/Prolia (denosumab), ESAs (erythropoiesis-stimulating agents), Sensipar/Mimpara (cinacalcet), Kyprolis and Evolocumab, among others. Source: www.schwab.com.

Yesterday I took advantage of recent dips in Biotech to reduce my cost basis on Amgen. I did the same thing with Gilead Sciences last week, a few days too soon, thanks to Hillary and her presidential agenda. Regardless, this yesterday my timing was better. I bought 20 shares of AMGN stock at $132 per share, totaling $2,640. This purchase adds $63 to my annual dividend income. With this purchase I now own 40 shares of Amgen at a cost basis of $142.88.

Amgen Dividends And Dividend Growth Rate

- Annual Dividend Yield of 2.28%

- 5-Year Dividend Per Share Average of $1.26

- 5-Year Dividend Yield Average of 1.14%

- 3- Year Dividend Growth Rate of 63.3%

- Payout Ratio (TTM) of 36.61%

- Dividend Coverage Ratio (TTM) of 273.19%

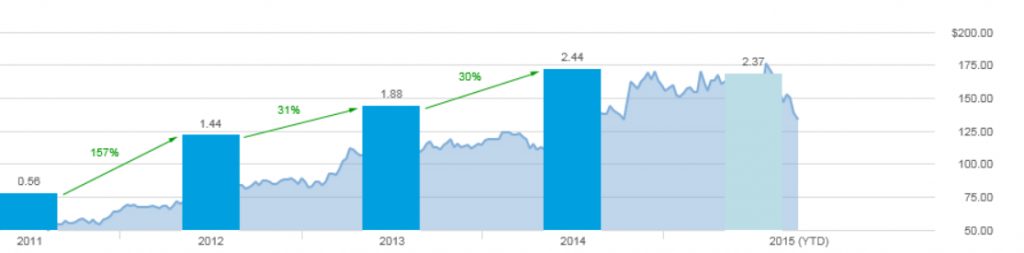

The chart below shows the past 5 years of annual dividends for Amgen. Although Amgen has only been paying dividends for 5-years, the company has increased its dividend annually by substantial amounts.

Amgen Valuation

S&P Capital IQ ranks AMGN as 4-stars, a buy with a fair value calculation of $161.40 and a 12-month target price of $202.

Morningstar ranks AMGN as a buy, 5-stars with a fair value of $198.

Argus ranks AMGN as a buy with a target price of $194.

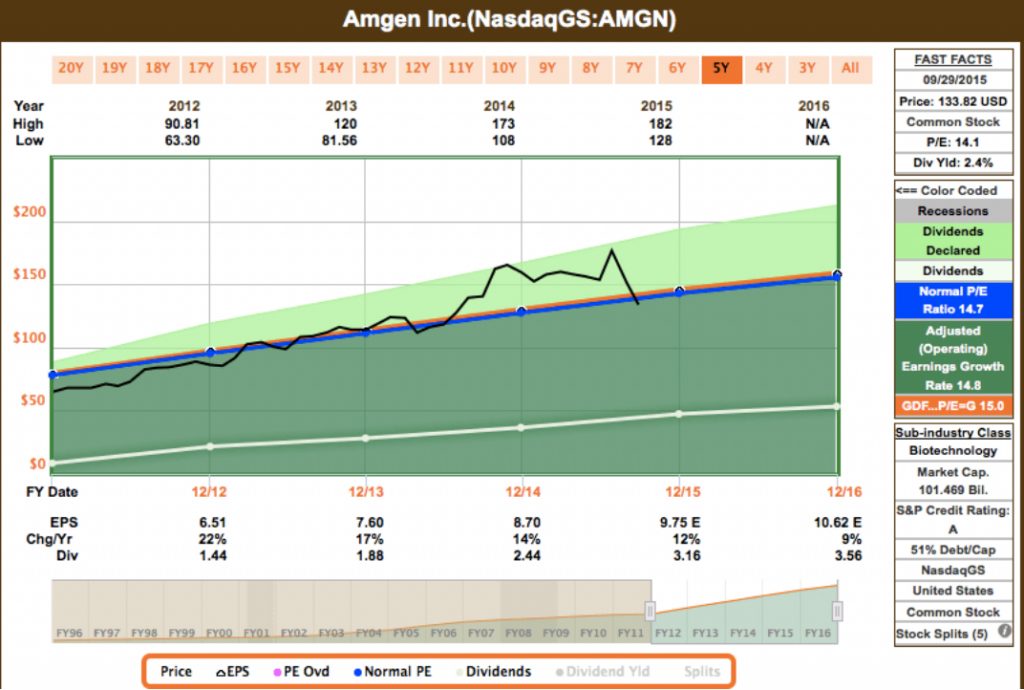

The F.A.S.T Graph below shows that Amgen has fallen below the blue line. For those of you unfamiliar with this tool ,when the black line falls below the blue line this indicates a stock is undervalued. In this case, Amgen is mildly undervalued according to the graph. Amgen has traded at a premium the past 18-months, so I consider this a good deal.

Conclusion

Amgen is a biotech powerhouse with a robust pipeline of products. I will continue adding to my positions of Amgen and Gilead as long as the market continues to devalue biotech stocks. There will likely be more dips in the near future because the Democratic party has targeted prescription drugs on their presidential agenda. This is a good thing, as markets will react and more deals will be out there. However, regardless of who wins the presidency, I am not concerned. In my lifetime presidents rarely keep any promises made during elections.

What do you think of my AMGEN buy? Do you invest in Biotech?

Full Disclosure: Long AMGN