Over the past month I’ve set aside time to learn about options trading. I had not thought about adding options to my retirement strategy until Seeking Alpha commenters suggested I’d be better off selling puts instead of buying stocks at current valuations. Not having an understanding of options trading, I decided now is a good time to learn. I purchased and read two books, read a few more at my local library and have been scouring the Internet reading about options trading. Once comfortable I decided to experiment with trading options. In this article I will discuss the options trading strategies I am experimenting with and I will show you all thirteen trades I made this month.

Why Options Trading

When I first started investing I had a small amount of capital to invest. Most of my monthly trades were less around $1,000. At that level of investing, options did not make much sense. I didn’t have enough shares of any one stock to sell a covered call and not enough capital to sell a cash secured put. I knew what these trading instruments were, but I was not in a position to take advantage of them.

Today my investment portfolio is valued at over $150,000 and I do own more than 100 shares (the required minimum number of shares for an options contract) of several stocks. Additionally, the 401k rollover I made in March of this year has left me with a sizable cash fund in my IRA. As of this writing, I have $67,000 sitting in cash earning a whopping 0.01% interest rate in my Investment Hunting portfolio. I could use my excess cash to buy up a handful of stocks but there are not many deals to be found these days.

My solution – Sell covered calls and cash secured puts. SELL is the key word here. I plan on only selling options, collecting a premium, watching my options expire, and selling new options. I will mostly sell “out of the money” contracts so the odds of me having to honor a covered call or execute a cash secured put are low. There will be times where the market doesn’t move in my favor and I will be forced to sell or buy a stock. I am fine with this scenario because I have a trading constitution that I follow.

My Options Trading Constitution

1. I will only sell options

2. I will sell calls, but only covered calls

3. I will only sell covered calls on stocks I am prepared to lose

4. I will sell cash secured puts

5. I will only sell cash secured puts for stocks I am prepared to own

6. I will monitor my options contracts and close contracts early when necessary

7. I will never buy or sell naked options.

[sa_captivate]

This is it. My options trader constitution. Sounds simple enough, what could go wrong?

Options Trading – What could go wrong

Just search Google with the terms dangers of options trading to learn all about the kind of messes investors have and can find themselves in. For the purposes of keeping this post brief, I’ll review the risks to me as an options seller. I’ll use IBM as an example throughout this article.

Covered Calls

A covered call is a contract sold to an investor that gives the investor temporary control of an option contract (100 shares of stock). The purchaser has the right but not the obligation to exercise the contract at any time prior to contract expiration if the stock goes above the contracted price. For example: I sell an IBM covered call at $165, expiring on 5/15/2015. On 5/15 IBM stock is trading at $170. Because I sold the option, the purchaser gets to buy my IBM stock for $165.

Risk 1

The first risk is time to expiration. If IBM reports horrible earnings and the stock drops significantly, I cannot sell my shares because I have contracted them to a buyer. The only way for me to sell my shares before contract expiration would be for me to “buy to close” the contract; this could cost me more than I earned by selling a contract. My takeaway, monitor every stock I sell covered calls on and buy to close the contract if needed.

Risk 2

Losing out on potential gains. IBM reports record earnings and its stock jumps to $180 a share. Since I sold a contract, this gain is the advantage of the purchaser. I will earn money up to $165 per share and the purchaser will get the revenue upside. My takeaway, only sell covered calls for stocks I am willing to lose.

Here is a real trade I made earlier this month with my PBR stock that is currently experiencing this scenario. On April 8th, I sold 7 contracts (700 shares) of PBR stock. The actual sale was PBR, 5/8/2015 $8.00C, which means a call contract expiring on 5/8 that gives the purchaser the option to buy my shares at $8.00 per share.

This sale generated instant profit of $135.72. At the time this seemed like a great deal for me. Four days later, PBR announced the potential release of audited financials on April 22nd. Today PBR stock is hovering just under $9.00, and if the results of the audit are favorable the stock could continue to rise prior to the 5/8 expiration date. As of today I sold the contract for $135.72, but I am losing out on $698 in stock appreciation.

I still have two weeks remaining on my options contracts, who knows where PBR stock will be on 5/8. In my perfect world, PBR closes on 5/8 at $7.99 and the contract expires; I keep the stock and I get to sell another covered call.

My takeaway, regardless of the outcome, I risked PBR stock because I was comfortable with someone taking it from me at $8.00 per share. I have already made $2,300 + $135.72 totaling $2,4375.72 on this stock in less than 60 days.

Cash Secured Puts

A cash secured put is an options contract that gives the seller temporary control of an option contract (100 shares of stock). The seller has the obligation to exercise the contract at expiration if the stock drops below the contracted price. Looking at the IBM example above, let’s say I sold a cash covered put for IBM for $150, expiring on 5/15. This contract is way out of the money, nearly $15.00 from market value. The odds of IBM dropping $15 in less than 30 days are slim, but it could happen.

Risk 1

Buying a losing stock. If IBM stock drops to $140 by 5/15, as the seller I am obligated to purchase 100 shares at $150. The loss would be slightly offset by any premium I received as a seller.

Risk 2

Major market corrections. The big market correction everyone has been talking about for the past 12-months actually happens on 5/14. I could be forced to buy IBM for much lower, $120, $100, etc. This is a bad scenario. The worst case scenario would be a stock price drop to zero. This is why I plan on only selling cash covered puts for companies I believe in and want to own a portion of.

My Options Trading Transactions

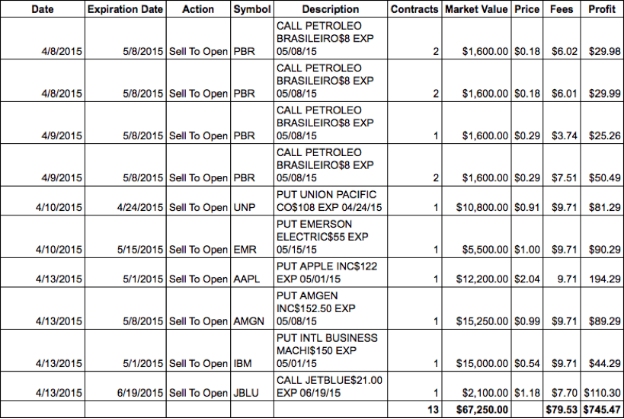

This month, I sold to following options contracts:

I sold 13 contracts for a profit of $745.47. This is a 1.1% return on my cash. If I can duplicate this every month for the remainder of the year my idle cash will generate $6,709.23. Annualized, this totals $8,945.64 or a 13.3% return. This is possible assuming all of my contracts are not executed. This is a perfect world scenario. Ideally, most of my contracts will expire useless and a handful will allow me to buy stocks at a discount. It’s a win-win scenario.

Options Trading Conclusion

Please note that I am new to options trading. I am sure I will make mistakes along the way. This is true of any learning process. If I could go back I would not have sold my PBR contracts.

I will likely lose out on PBR gains. However, as mentioned earlier, I am fine with the profit I have made thus far on PBR. If I do lose my shares, I will have $7,500 to buy more stock or sell more cash secured puts. Looking back, I would also look for contracts paying a bit more than some of my transactions.

The options market can be dangerous, but by only selling against stocks I own or cash I have in hand I have minimized my exposure and risk. Options appear to be a great way to supercharge my retirement portfolio. I will continue to explore options and start testing different strategies.

By continuing to learn about options, I believe I can get to a point where I can earn $1,000 a month selling covered calls and cash secured puts. $12,000 a year selling options would be fantastic for my portfolio, especially considering this is all taking place in ROTH and traditional IRAs. I will employ this strategy until such time as the market offers attractive entry points. Then I will buy stocks at a reasonable price and continue selling covered calls on those stocks.

Do you trade options? What are your options trading strategies? What advice would you give me as a new options trader?