One of my 2017 goals is to diversify my investments to include more areas than just the stock market. I invested $2,500 into Lending Club, which is a Peer-to-Peer lending network. Click on this link to learn more about my Lending Club strategy.

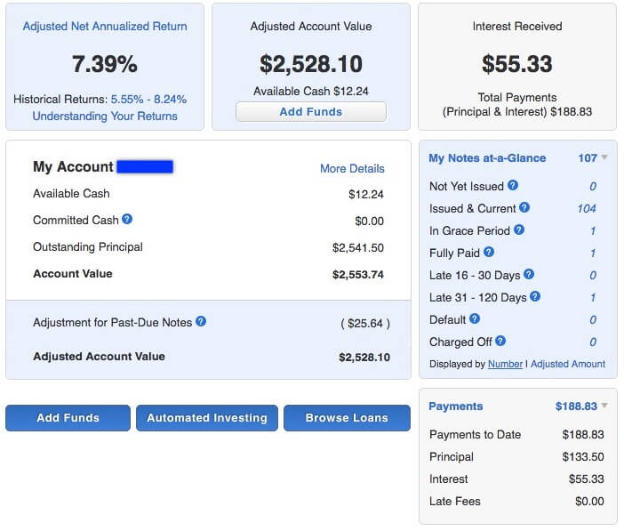

This post documents month two of my Lending Club journey. In this month I’ve seen my Adjusted Net Annualized Return go from 6.72% in month 1, up to 7.39% in month 2. I’ve also gone from 100 initial funded loans to 103 in month one and up to 107 today. I’m using Lending Club’s automated investing tool. This tool funds new loans when my account reaches $25 in value. This value comes by way of returned capital and interest payments.

Lending Club Month Two Results

To date, I’ve received payments totaling 188.83. This month I received $78.64. The breakdown of payments are: $29.21 in interest and $49.43 in returned principal. My adjusted net annualized return is now 7.39%. The image below shows the details of my investment and performance.

Last month, I had two loans in the payment grace period. This month I have one loan in the grace period and another loan that is 31 – 120 days late. Right now it’s 63 days late. It appears that some loser took out a $25,000 loan with no intention of paying it back. Oh well, this is why I only fund $25 per loan.

I expect to fund 4 new loans over the next 30 days, which will take total loans funded to 111. As mentioned last month, I’ll continue funding loans with returned capital until such time as I notice defaults increasing to a level where it make no sense to continue. Right now, with 107 loans funded and only 2 in default, I’m OK reinvesting. After all, this represent a default rate of less than 2%. Banks would kill for default rates this low. Having said that, I’m only entering month 3, so anything can happen.

I’ll be posting monthly updates, so you all can follow along and see how Lending Club performs. I’ll also be adding my Lending Club monthly income to my monthly total income posts.

Do you have money invested with Lending Club, Prosper, or another P2P service? If yes, how are your loans performing?