Last week I added a new stock to my Investment Hunting portfolio. I’ve had Cummins Inc. (NYSE: CMI) on my watchlist for 13-months. This past month Cummins stock has taken a nosedive which is not surprising given a recent overall market dip. I bought 25 shares of Cummins stock at $128.98, totaling $3,224.50. This purchase adds $78 to my annual dividend income.

I was really happy with my entry price, however 24 hours later the stock price dropped $5.42. I still like my price, but $123.56 would have tasted much sweeter. Cummins stock is down 19% this year and 26% over the last 12-months.

For this post I am going to display metrics for Cummins as they were at market close Friday, July 24th 2015. I am doing so because of the large price drop that happened right after my purchase. For the record, I think this stock was a great buy at the price I paid, however since I didn’t write this post immediately after purchase, I am using the latest metrics on Cummins.

Cummins Overview

Cummins Inc. is a global diesel engine manufacturer. The Company designs, manufactures, distributes and services diesel and natural gas engines and engine-related component products, including filtration, after treatment, turbochargers, fuel systems, controls systems, air handling systems and electric power generation systems. It has four operating segments: Engine, Distribution, Components and Power Generation. The Company sells its products to original equipment manufacturers (OEMs), distributors and other customers. It serves its customers through a network of around 600 Company-owned and independent distributor locations and around 7,200 dealer locations in more than 190 countries. In addition, engines and engine components are manufactured by the Company’s joint ventures or independent licensees at its manufacturing plants in the United States, China, India, South Korea, Mexico and Sweden. Its subsidiaries include Cummins India Ltd. and Wuxi Cummins Turbo Technologies Co. Ltd.

Source: www.schwab.com.

Cummins Dividends And Dividend Growth Rate

- Annual Dividend Yield of 2.46%

- 5-Year Dividend Per Share Average of $1.81

- 5-Year Dividend Yield Average of 1.50%

- 3- Year Dividend Growth Rate of 28.5%

- 5- Year Dividend Growth Rate of 32.0%

- 10- Year Dividend Growth Rate of 25.1%

- Payout Ratio (TTM) of 31.59%

- Dividend Coverage Ratio (TTM) of 316.57%

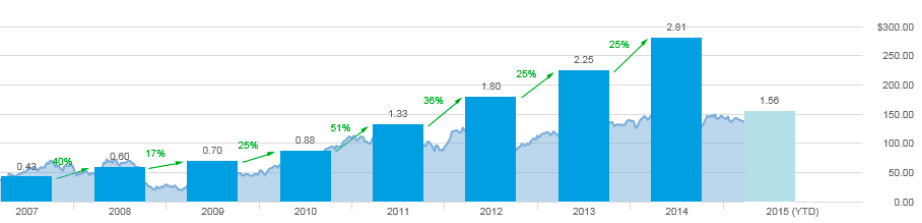

The chart below shows the past eight years of annual dividends for Cummins. This chart visually represents how impressive dividend increases have been for CMIthe past eight years. CMI boast an impressive 25.1% 10-year dividend growth rate. Given that CMI has a payout ratio of 31.59%, this company has the ability to continue impressive increases or maintain dividend payouts if times get tough.

On July 14th of this year, Cummins quarterly cash dividend on common stock was increased 25 percent to 97.5 cents per share from 78 cents per share. A 25.1 % dividend growth rate the past 10-years, and a 25% dividend increase this year. This stock is a DGI investors dream!

Source: Schwab.com

Cummins Valuation

S&P Capital IQ ranks CMI as 5-stars, a strong buy with a fair value calculation of $159.50 and a 12-month target price of $180.

Morningstar ranks CMI as a hold, 3 stars with a fair value of $134. Argus ranks CMI as a buy with a target price of $170.

Using my dividend toolkit I used the dividend discount model analysis with the following metrics: 10% Discount Rate and an 8% Dividend Growth Rate. I get a fair value of $168.48.

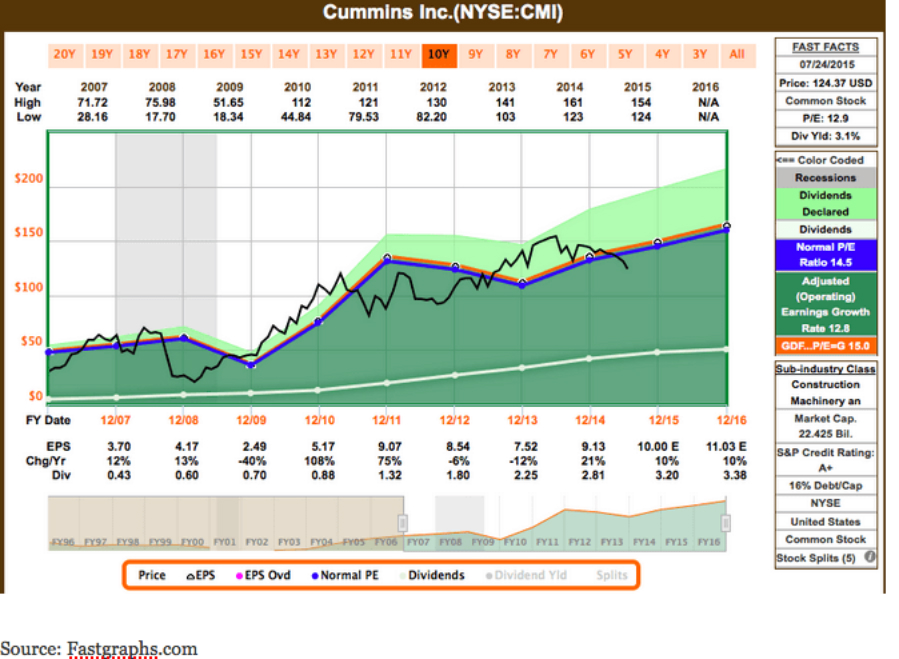

A 10-year FAST Graphs view shows that Cummins is an undervalued stock. If you have not used FAST Graphs, when the black line is below the blue line a stock is undervalued. The blue line illustrates the normalized P/E Ratio of a stock; so in the image below, for the past 10-years, CMI has a normal P/E of 14.5. As of 7-24-2015, CMI P/E is 12.9.

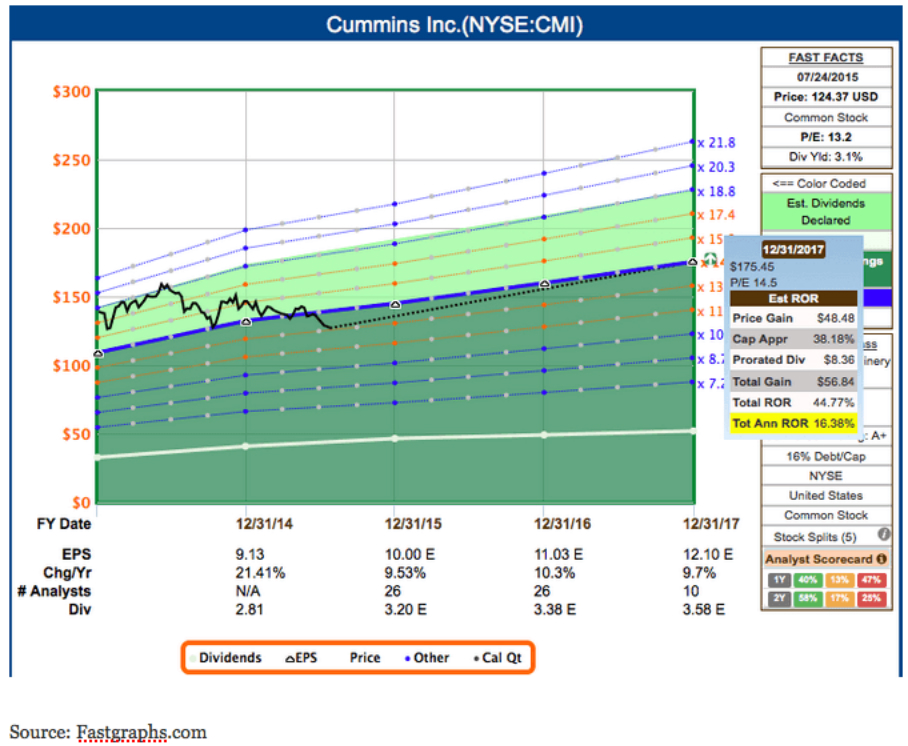

I chose to buy CMI because I believe in the next 5-10 years of growth for this company. In the chart below, I have taken the 10-year normalized P/E Ratio of CMI and used FAST Graphs EPS forecasts through 2017. The chart shows a stock price of $175.45 as of 12/31/2017. This is a price gain of $48.48 per share.

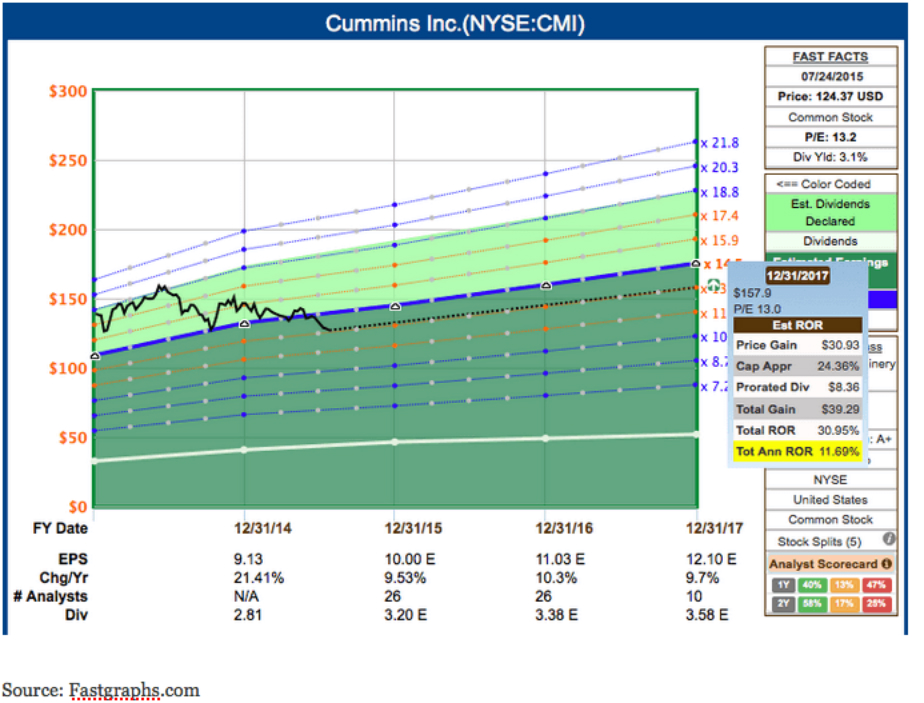

Is the chart above too aggressive? Maybe. The next chart shows the same thing but assumes the CMI P/E Ratio stays where it is today, 13.2; actually slightly lower at 13.0, because FAST Graphs didn’t list 13.2. Based on future estimates at the same P/E Ratio, CMI is still a great buy. A stock price of $157.90 on 12/31.2017.

Conclusion

Market volatility has created many buying opportunities. I have been adding to existing positions the past few weeks, but this time I thought why not add a new stock from my watchlist. Cummins has shown a dedication to investors through dividend payouts and continuous dividend increases. Given that Cummins payout ratio is still low, I feel this company is a great investment. I’m not the only dividend investor who thinks Cummins is a good investment. Below are links to a few CMI stock buy or analysis posts from the dividend blogging community:

Dividend Empire

Average Dividend Yield

DivGro

What do you think of my Cummins buy? Are you buying stocks right now or waiting for a larger market adjustment?

Full Disclosure: Long CMI