This Friday, my 2014 IRA will be rolled over to a ROTH IRA. On Friday, I am buying some PBR, not Pabst Blue Ribbon, but Petróleo Brasileiro S.A., better known as Petrobras. Petrobras has the coolest stock ticker ever, PBR. Not many companies can say that their stock tickers are mentioned in country songs, 80s movies, hipster bars, and are the symbols of an American beer comeback story. Petrobras and Pabst Blue Ribbon are similar. Can Petrobras make a comeback rivaling that of Pabst? I am betting on it.

About PBR

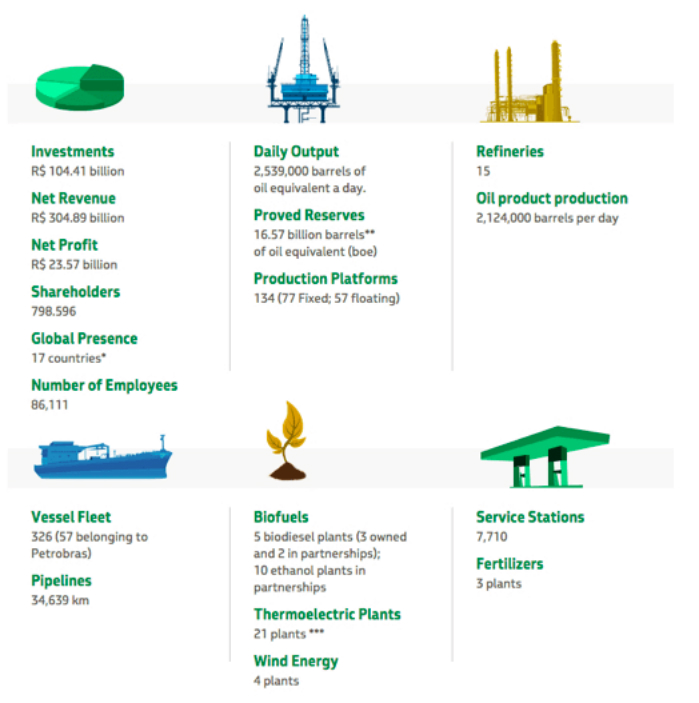

Founded in 1953, Petrobras is a semi-public a Brazilian multinational energy company. By semi-public I mean the government of Brazil owns the majority share of this publicly traded company. PBR is involved in exploration and production, refining, marketing, transportation, petrochemicals, oil product distribution, natural gas, electricity, chemical gas, and biofuels. A visual list of Petrobras operations is shown in the image below.

*Image provided by Petrobras Investor Relations

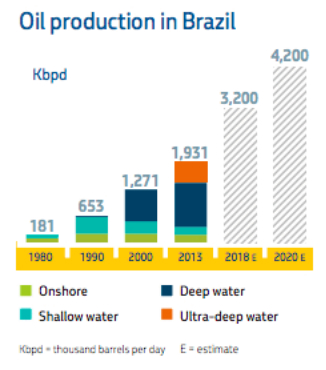

PBR specializes in Deep water and Ultra Deep Water oil production. Deep waters is where I see PBRs competitive advantage. The company is regarded as the industry leader in deep water exploration. Please note that the chart below was created prior to the announcement of asset sales. Future oil production estimates are likely lower than the projections shown.

* Image provided by Petrobras Investor Relations.

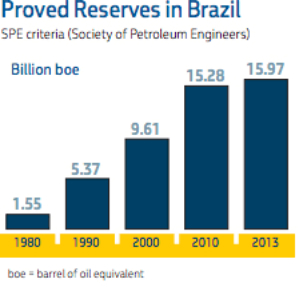

PBR is sitting on a goldmine, actually an oil mine in deep water reserves. As of 2013, PBR had 15.97 billion BOE (barrel of oil equivalents). I get excited by this number.

* Image provided by Petrobras Investor Relations.

PBR – Risk Versus Reward

All investing comes with risk. PBR is riddled with risk. PBR also has the potential to provide above average reward to those willing to accept risk. For this article I am sparing you all from my traditional financial and ratio analysis. I am doing so for two reasons, 1 – I don’t trust the latest released financials, 2 – I am not buying PBR because of outstanding financials, I am taking a chance.

PBR Risks

Sector Risk – The energy sector, particularly oil, is down. This risk effects all oil companies.

Political Risk – Government control is never ideal, especially when the government is corrupt. PBR is currently involved in a massive scandal consisting of kickbacks, bribery and pocket lining by executives, political leaders and PBR contractors. The extent of corruption is still unknown. This scandal is a major risk to the viability of PBR.

Debt and Credit Risk – PBR is in debt to the tune of more than $170B. Additionally, earlier this week Moody’s dropped PBRs credit ratings to junk status. Actual changes – Moody’s downgraded all ratings for Petrobras. The change included debts rated based on Petrobras’ guarantee, including a downgrade of the company’s senior unsecured debt to Ba2 from Baa3. Additionally Moody’s gave a Ba2 corporate family rating to the company. Moody’s also lowered the company’s baseline credit assessment to b2 from ba2.

PBR Rewards

If an investor has the stomach to wager a bet on Petrobras, the reward could be massive. PBR stock is trading at $6.41 per share, which is near the 1-year low of $5.79. The current stock price is 69% off of the Petrobras 12-month high of $20.94.

I am hoping for a 7-times increase but I expect a 3-times increase in the next 24-months. Honestly, even if I doubled my money I will be happy. I see Petrobras as an opportunity to take a $5,500 investment to between $15,000 and $30,000 over the next few years.

The chart below shows PBR stock prices from 2008 to present. I have identified a few prices that I hope the stock settles on in the next 24-months. One can dream

PBR – Final Thoughts

PBR is a troubled company. However, Petrobras is in the world spotlight, which makes buying this stock interesting to me. In the past few weeks Petrobras has replaced its CEO, hired a U.S. accounting firm to audit financials, cooperated with Brazilian federal prosecutors, and announced the sale of nearly $16B in assets over the next 2-years. These are all positive signals. Time will tell is cooperation will continue. The extent of this scandal is still unknown. I suspect many high level politicians will get wrapped up in this mess.

Investing is risky. I have no illusions that investing in PBR is more risky than sticking to JNJ, T, or GE. These stocks are fantastic for limited gains and excellent dividends. I am a dividend investor but I still have a Las Vegas poker side to me. Petrobras is my Las Vegas trip. I like to take a bet on one stock every year; last year my bet was on NMM, this year PBR. My bet is on stock value appreciation, not dividends. If all goes according to plan, I will sell Petrobras at a handsome profit and invest my earnings into high value dividend paying stocks. If all goes south and Petrobras goes bankrupt, I have not invested too much money to hurt my portfolio or family. Taking a risk on Petrobras is worth it to me. The risk may not be worth it to you. As always do your own homework and only invest in what you personally have evaluated and trust. I am not a financial advisor. I am simply writing about how I invest my money.

Assuming Petrobras stock stays below $6.50, this Friday I am buying $5,500 worth or 858 shares.

Personal Disclosure – I did drink several PBRs while writing this article

Full Disclosure – Long, JNJ, T, GE, NMM. I am considering initiation a position in PBR in the next 72-hours.